FOR ENTERTAINMENT PURPOSES ONLY

Last Updated- September 28, 2023

Doubleview Gold On the Path Towards Becoming the Most Valuable & Most Desirable Deposit in Canada & NA

Porphyry deposits supply over 70% of the world’s copper production. Due to the Green Energy Transition, the upcoming demand for copper over the next few decades is said to be more than what has ever been mined in history!

In addition to copper, porphyry deposits also supply a significant amount of silver and gold. Some unique deposits also contain significant amounts of other critical metals.

As a result of their size and vast amounts (weight) of metals contained, porphyry deposits are the most valuable deposits on the planet and have the longest mine lives. This is what makes them extremely desirable to major mining companies.

With the Green Energy Transition upon us, the demand for critical metals which are required for a “carbon neutral” economy will create supply deficits resulting in higher metal prices. The fear of upcoming supply deficits have caused some car manufacturers to sign supply deals directly with mining companies to ensure they can continue to produce vehicles in the future!

Although Doubleview Gold is said to contain 10 of the 31 critical metals on Canada’s critical metals list, this article will only focus on the 2 critical metals (copper & scandium) and 1 precious metal (gold) which have all been deemed recoverable with metallurgical testwork and are in abundance in the deposit. Although the deposit contains a lot of cobalt which is also critical metal, it won’t be included as it’s definitely not required to show how significant the potential value is.

Example of the Potential Tonnage

All calculations in this article are simple “back of the napkin estimates” and are NOT mining compliant estimates.

On 18 Sept, 2023, Doubleview Gold stated the total drilled dimensions of the Lisle zone was ~1,450 metres (north-south) X ~1,400 metres (east-west).

1400 x 1450 x 400 x 2.5 = ~2.03 billion metric tonnes*!

*assumes the dimensions are a perfect square when it isn’t, assumes an average depth of 400m (most of Doubleview Gold’s holes are over 500m in length and some over 700m), assumes SG is 2.5 and it doesn’t account for a cut-off grade (this is only an example to show how much tonnage is contained using the given dimensions and assumptions).

As the company continues to expand the drilled dimensions of the deposit, the tonnage will increase and consequently, the amount of the metals contained in the deposit will also increase!

As a reminder, Doubleview Gold’s 3D-IP footprint is 2.7km x 3.7km making it one of North America’s largest so it could potentially contain many many billions of metric tonnes!

Example of the Potential Amount of Each Metal

Let’s look at a simple example to show how quickly the value can add up using only Doubleview Gold’s copper, scandium and gold.

For every 1 billion metric tonnes, the potential amount of each metal is as follows:

- 0.20% copper* = ~4.41 billion lbs

- 0.20 g/t gold* = ~5.83 million oz

- 30 g/t scandium* = 30 billion grams

*Uses the same assumptions/values used in the potential metric tonnage calculation plus an estimate of Doubleview Gold’s average grade for the metals.

Although some BC porphyry mines in production are mining similar grades, I expect Doubleview Gold’s average grades to increase once it finds the deposit’s heat engine/feeder system which is where the highest grades and longest intervals are found in porphyry deposits. Once found and depending on the grades/intervals, it can drastically improve the deposit’s average grades. Based on the company’s news release on 18 Sept, 2023, it seems to believe that it has found the heat engine/feed zone of the Lisle Zone as it named the newly discovered extension area the “Feeder Zone” (link to news release). Assay(s) from the “Feeder Zone” is/are currently pending.

Example of the Potential Insitu Value

Let’s look at an example of the potential insitu (in ground) value of the metals. The current price of gold and copper at the time of writing will be used.

For every 1 billion metric tonnes, the potential insitu values are as follows (uses Doubleview Gold’s metal recovery rates as determined by metallurgical testwork):

- 4.41 billion lbs* copper @ 84% recovery & US$3.70/lb = ~US$13.704 billion

- 5.83 million oz* gold @ 89% recovery & US$1865/oz = ~US$9.682 billion

- 30 billion grams* scandium @ 90% recovery & US$2/gram = ~US$54 billion

POTENTIAL TOTAL INSITU VALUE FOR EVERY 1 BILLION METRIC TONNES:

~US$77.386 billion* or ~CAD$104.472 billion*

*Uses the same assumptions/values used in the examples of the potential tonnage & potential amount of metals.

Example of the Potential Acquisition Price (Simplified Version)

The simple retail investor method for calculating what a deposit might get acquired for is to use 1% to 2% of the insitu value.

The following per unit metal prices are simply so they can be compared with the advanced method.

1% represents the following price per unit of metal when using US$1865/oz gold, US$3.70/lb copper & US$2/gram scandium:

- US$0.037/lb copper

- US$18.65/oz gold

- US$0.02/gram scandium

2% would give the following:

- US$0.074/lb copper

- US$37.30/oz gold

- US$0.04/gram scandium

For every 1 billion metric tonnes, 1% & 2% of the potential insitu value is as follows:

- 1% = ~CAD$1.045 billion

- 2% = ~CAD$2.089 billion

As of 31 May, 2023, there were ~213 million shares fully diluted. The company has not done any financings and is fully funded for the remainder of this year’s drilling. Since the company did issue options and for simplicity, I will blindly add another 17 million shares. All estimated price per share calculations will use 230 million for the fully diluted number of shares.

FOR EVERY 1 BILLION METRIC TONNES OF A NI 43-101 RESOURCE ESTIMATE (1% INSITU VALUE), THE ESTIMATED PRICE PER SHARE COULD POTENTIALLY BE AS FOLLOWS:

~CAD$4.54

FOR EVERY 1 BILLION METRIC TONNES OF A NI 43-101 RESOURCE ESTIMATE (2% INSITU VALUE), THE ESTIMATED PRICE PER SHARE PRICE COULD POTENTIALLY BE AS FOLLOWS:

~CAD$9.08

Example of the Potential Acquisition Price (Advanced Method)

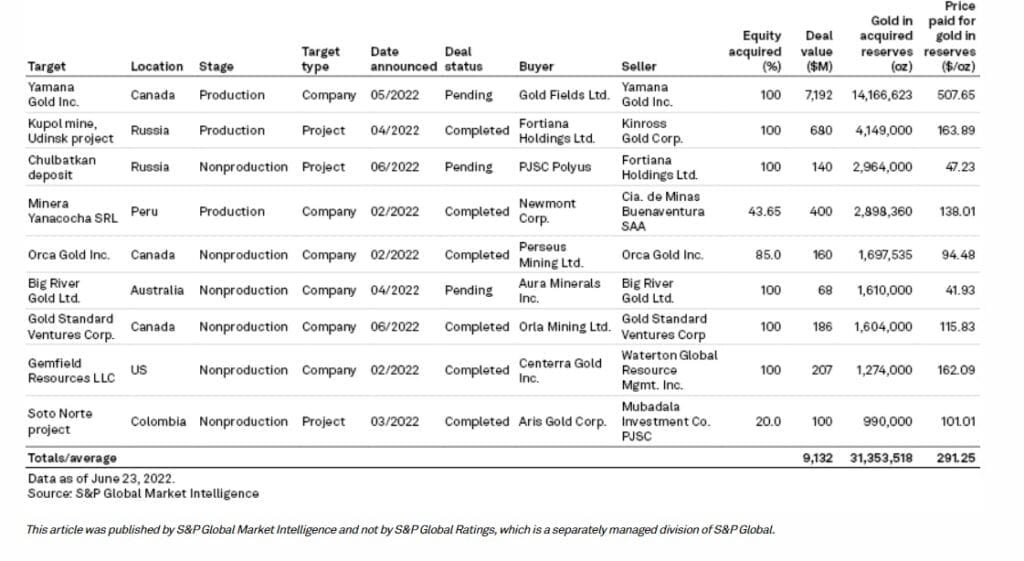

The advanced method used by analysts is to use the price paid in other acquisitions.

The easiest method is using the Copper Equivalent from a NI 43-101 resource estimate and multiplying it by an average acquisition price per lb of copper divided by the number of fully diluted shares. While we wait for the maiden NI 43-101 resource estimate to be released, I will estimate it using copper, gold and scandium.

EXAMPLE 1 (uses the lowest prices)

Example 1 uses the lowest acquisition price per gold oz for a junior for the period of 2012-2021, the average price per copper lb for juniors in 2022 and US$2/gram for scandium.

For every 1 billion metric tonnes, the potential acquisition price is estimated as follows:

- 4.41 billion lbs copper @ 84% recovery & US$0.03/lb (0.81% of US$3.70) = US$111.1 million

- 5.83 million oz gold @ 89% recovery & US$18.04/oz (0.97% of US$1850) = US$93.7 million

- 30 billion grams scandium @ 90% & US$0.02/gram (1% of US$2) = US$540 million

TOTAL POTENTIAL INSITU VALUE = ~US$744.8 million = ~CAD$1.005 billion FOR EVERY 1 BILLION METRIC TONNES IN A NI 43-101 RESOURCE ESTIMATE, THE POTENTIAL PRICE PER SHARE IS AS FOLLOWS:

~CAD$4.37

EXAMPLE 2 Example 2 uses the lowest acquisition price of a non-producing gold acquisition in 2022, the average cost of non-producing copper acquisition in 2022 and 2% of the 2023-2024 price forecast for scandium since it’s potentially one of the largest scandium deposits in the world & is potentially the lowest-cost scandium in the world.

For every 1 billion metric tonnes, the potential acquisition price is estimated as follows:

- 4.41 billion lbs copper @ 84% recovery & US$0.06/lb (1.6% of US$3.65) = US$222.23 million

- 5.83 million oz gold @ 89% recovery & US$41.93/oz (2.2% of US$1850) = US$217.69 million

- 30 billion grams scandium @ 90% & US$0.04/gram (2% of US$2) = US$1.08 billion

TOTAL POTENTIAL INSITU VALUE = US$1.52 billion = CAD$2.052 billion FOR EVERY 1 BILLION METRIC TONNES IN A NI 43-101 RESOURCE ESTIMATE, THE POTENTIAL PRICE PER SHARE IS AS FOLLOWS:

~CAD$8.92

Comments on the Estimates

SCANDIUM PRICE USED

For the scandium price, the price used (US$2) was the one that was approved by the stock exchange for use in Doubleview Gold’s Copper Equivalent (Energy, Metals and Agriculture Consensus Forecasts for 2023 & 2024).

It is important to note that the company announced a while ago that it was working on producing commercial saleable scandium salts. In 2020, the price of 5 different scandium salts ranged from US$3.80 and $US214 according to the United States Geological Survey! In the news release on 26 Sept 2023, the company said “The Metallurgical testwork is now advancing to the next level of producing a final scandium product.” Have a look at the USGS chart for the different scandium salt prices below.

If Doubeview Gold can produce the highest priced scandium salts such as scandium fluoride, the total potential resale value would be the equivalent of a 100 fold increase in the scandium insitu value (from US$54 billion to an insane US$5.4 trillion). Just for fun, 1% of such a hypothetical insitu value for only the scandium would equal ~CAD$317 per share! Although this is a hypothetical example as all the scandium would never be able to be sold at such high prices due to the laws of supply and demand, it would still result in a ridiculous amount of potential revenue if Doubleview Gold’s scandium does turn out to be the lowest cost scandium in the world!

CONCLUSION ON THE ESTIMATES

The following items would increase the estimates for every 1 billion metric tonnes (applies to the metals used in the calculations):

- an increase in a metal price as supply deficits approach

- an increase in the per unit acquisition cost of a metal

- an increase in the average grades of Doubleview Gold’s deposit

Regardless of the method used to calculate the potential share price in a buyout scenario, the potential price per share were generally similar. In the end, the buyer and the seller ultimately determine what it gets sold for.

It is important to remember that all the calculations in this article were for every 1 billion metric tonnes of a NI 43-101 resource estimate.

If Doubleview Gold proves up 4 billion tonnes in a future NI 43-101 resource estimate (assuming the average grades, fully diluted shares and avg price paid haven’t changed), one simply needs to multiple all the potential share price acquisition scenarios by 4!

Opinion of a Former Portfolio Manager & a Former Manager That Both Managed Over US$1 Billion Funds

Although the following is NOT investment advice, here are the opinions of 2 people that managed over US$1 billion funds. One believes Doubleview Gold can potentially be worth CAD$10 and the other CAD$5 to CAD$10 if all goes to plan!

Although both are posting anonymously on X, I know who both are and I have no doubt about their past backgrounds as significant fund managers. I have personally found online information that confirms the background of 1 of these individuals.

I also know that both own a significant amount of shares in Doubleview Gold. I believe one of them is most likely the 2nd largest shareholder (direct ownership & shares under their control) after the company’s CEO/President.

Premiums on Future Critical Metal Acquisitions

With certain critical metals like copper which are crucial for a Green Energy Transition to occur and significant supply deficits expected, companies/shareholders will demand higher premiums on acquisitions. They know a little more patience will result in being able to get that higher premium as the metal price increases!

It is important to remember that unique, one of a kind deposits often get top dollar per oz/lb simply because there’s no other similar alternatives. A bidding war for a deposit also results in higher premiums.

In Doubleview Gold’s case, I believe the deposit is extremely unique and there is nothing similar to it in North America. It’s in the most desirable jurisdiction to put a critical metals into production. Since the 3D-IP (chargeability body of 2.7km x 3.7km) has been accurately validated with drilling, the remainder of the undrilled areas allows a major mining company to comfortably apply a extra premium if required as it provides confidence that it is also likely mineralized with similar grades. Since Doubleview Gold’s scandium extraction process is unique and if it does produce the lowest-cost scandium in the world, it could fetch a significant premium as it will be a game changer for the economics of the mine as well as the whole scandium industry.

Although there were no premiums added to the potential acquisition price per share estimates, I do believe Doubleview Gold will likely receive a premium.

Copper Leads the Pack for Acquisitions

Canada is the Most Desirable Critical Metals Jurisdiction

Other than the deposit itself, jurisdiction is next most important thing to major mining companies.

When it comes to mining, Canada is a tier 1 mining jurisdiction. Non-tier 1 mining jurisdictions have elevated political risk and in the last few years some South American countries have been wanting a bigger share of the profits.

In Canada, a critical metal is a metal that is essential to Canada’s economic security and its supply is threatened. In general, critical metals are required for Canada’s transition to a “low-carbon economy.” Many other Western counties such as the United States have similar critical metals lists.

In 2020, Canada and the U.S. finalized a Joint Action Plan on critical minerals collaboration due to Canada’s potential role to establish a North American critical metals supply chain.

Canada’s critical metals strategy makes it the most desirable mining jurisdiction to develop critical metals deposits. The Canadian Critical Metals Strategy was released in 2022 and it aims to expedite the development of critical metal deposits. The strategy involves helping companies apply for permits and for federal support through the Critical Minerals Centre of Excellence.

Although Canada has a list of 31 critical metals, the strategy currently prioritizes lithium, graphite, nickel, cobalt, copper and rare earth elements. Doublview Gold has significant amounts of copper, cobalt and scandium (all deemed recoverable with metallurgical testwork). Scandium is considered a rare earth and the Canadian federal government recently gave Rio Tinto money to help it become the 1st scandium producer in North America.

As a result of Canada’s aggressive critical metals strategy, it is the most desirable location to develop a critical metals deposit.

BHP – World’s Biggest Miner Wants More Projects in “Desirable Canada”

The following section mostly contains quotes from the following article published on 22 February, 2023 by the Financial Post:

The world’s biggest miner is ready to plant more flags in ‘highly desirable’ Canada

“We see Canada as a highly prospective and desirable location to actually making investments” – BHP president of minerals for the Americas

“Still, BHP, like most miners these days, is optimistic. The demand for metals that are crucial in powering batteries and driving the transition to greener energy — primarily lithium, nickel and copper — is on the rise as more countries look to meet their climate goals. Major mining companies such as Teck Resources Ltd., Barrick Gold Corp. and Rio Tinto Ltd. have been involved in building, exploring and buying projects containing these minerals to take advantage of the boom.”

“Governments also want a piece of the action. Canada, for its part, is attempting to lure miners and automakers to the region through tax credits and funds in order to build its own electric vehicle industry.”

“BHP, which already produces a vast amount of nickel and copper at mines around the world, set up an office for minerals exploration in Toronto about a year ago. The group has a special focus on metals such as copper and nickel, and the objective is to find Canadian miners with good assets and invest in them.”

BHP’s president of minerals for the Americas “said that Canada’s recently announced critical minerals strategy makes it a “very very attractive jurisdiction” for BHP and aligns it with the “company’s priorities moving forward.”’

Rio Tinto – One of the World’s Biggest Miner’s Opinion on Canada

The following section mostly contains quotes from the following article published on 20 September, 2023 by the Financial Post:

Canada a ‘decade or two’ ahead of West in battle for climate change, says Rio Tinto CEO

“Canada is a “decade or two” ahead of other western countries when it comes to addressing climate change, Rio Tinto Lts’s chief executive Jakob Stausholm said.”

Jakob Stausholm (Rio Tinto CEO) “says he hopes to further invest in Canada’s critical minerals sector”

“We have to admit we have a significant carbon footprint, and we need to address that,” Stausholm said. “I just think Canada is an amazing opportunity.” – Rio Tinto CEO

‘”He said that in some cases, bureaucratic issues “can be cut,” but he still believes Canada is “more efficient” than other countries when it comes to permitting, including the United States.”‘ – Rio Tinto CEO

‘“The fact is the U.S. has not permitted a hard-rock mine since 2008,” he said. That’s actually a big difference between the U.S. and Canada. I would argue that a lot of good development is happening in Canada.”’ – Rio Tinto CEO

Rio Tinto – the Only Scandium Producer in NA

The following was taken from my scandium/metallurgical test tracker page:

In 2022, Rio Tinto became the first North American scandium producer after spending very significant amounts of money to develop an extraction process that works on its tailings.

Although it wants to become a global scandium supplier, it currently doesn’t seem to have the reserves to remain a global supplier if the scandium market grows significantly and is used in the transportation industry to reduce the weight of electric vehicles. Rio Tinto extracts scandium from the waste streams of titanium dioxide production and the final product is scandium oxide.

Although little is publicly known about Rio Tinto’s proprietary scandium extraction process, I believe Doubleview Gold’s proprietary scandium extraction process is superior due to what the world renowned metallurgist, who is up-to-date on the scandium market, has been saying about it.

Doubleview Gold’s Scandium

22 Feb 23 News Release:

“Even at moderate recoveries, the HAT deposit has the potential to meet international demand for scandium for the foreseeable future. As scandium is a by-product of a waste stream, recovery is not the fundamental driver, cost is. If it can be demonstrated that scandium can be recovered at an acceptable cost, then scandium has the potential to add significant value to the HAT deposit. A techno-economic evaluation for the production of scandium as a by-product of HAT copper-gold

production will be evaluated on conclusion of the test work phase.” – Andrew Carter (Technical Director, Mining & Minerals, Tetra Tech)

Andrew Carter (Technical Director, Mining & Minerals, Tetra Tech) has been supervising/guiding the metallurgical tests for ~3 years, is independent of Doubleview Gold and has been signing off on all metallurgical testwork news releases.

Tetra Tech market cap ~US$7 billion (as of March 2023)

Andrew Carter & his extensive background (link):

Andrew Carter is also one of 4 members of the Institute of Materials,Minerals and Mining which is one of six participating organisations of The Pan European Reserves and Resources Reporting Committee (PERC).

PERC Standard Members (link)

PERC is a constituent member of the Committee For Mineral Reserves International Reporting Standards (CRIRSCO) and is recognised by CRIRSCO as the National Reporting Organisation (NRO) for the Europe Region. As such, PERC is the European equivalent of JORC in Australasia, SAMREC in South Africa, and the other CRIRSCO regional member organisations. PERC, as a member of CRIRSCO, has an international forum that enables it to ensure consistency of its

reporting standards in an international setting, as well as contributing to the development of good practice in international reporting.

Doubleview Gold’s Proprietary Scandium Extraction Process

Since I have already fully discussed the advantages of Doubleview Gold’s unique scandium extraction process in a previous article, I will not mention it in this article. If interested, please see the following:

The skeptics ignore the scandium simply because the scandium grades are a fraction of the grades of typical scandium deposits and consequently, the bashers call it “scamdium” as they think Doubleview Gold’s scandium is a scam because of what it claims it can do with scandium!

The metallurgical testwork on the scandium started a few years ago. The bashers think both Doubleview Gold’s CEO/President and the independent world renowned metallurgist that has been overseeing the testwork and works for a ~$7 billion company are scamming the whole world about it.

Although I believe some bashers know what’s unfolding and might be intentionally bashing for strategic reasons, the ones that aren’t simply don’t understand or haven’t bothered to look into Doubleview Gold’s proprietary scandium extraction process. Doubleview Gold’s proprietary scandium extraction process is said to be revolutionary. What Doubleview Gold claims it does has NEVER been done before. It is able to extract much lower grades at significantly higher recovery rates with only limited additional costs which is said to be an industry first! To fully understand how much of a game changer Doubleview Gold’s scandium and scandium extraction process are it is crucial that one understands how scandium is currently extracted and why it results in the high cost of it (see the article at the beginning of this section for more info).

If Doubleview Gold’s scandium extraction process is what the company believes it is and it’s the lowest-cost scandium in the world, it would be a HUGE game changer for both the company and the scandium industry. If it does result in the lowest-cost scandium in the world it would put the current scandium mines out of commission if it can supply the scandium industry’s demand.

As a reminder, the cost analysis is expected to be in the Maiden Resource Estimate and could be announced separately in a news release within the next few months. Once released and if the company is correct about its results, I believe there will instantly be a HUGE rerating of the company’s stock price!

Due to Doubleview Gold’s revolutionary extraction process and it potentially owning the largest scandium deposit in North America, it could potential supply the whole scandium market with the cheaper scandium prices it requires to allow mass usage of it.

Rio Tinto wants to become a global supplier in the scandium industry. If Doubleview Gold proves that it owns the largest scandium deposit in North America and has the lowest-cost scandium cost in the world, how desirable would it be to Rio Tinto? Would Rio Tinto (one of the world biggest mining companies of the world) let another competitor take control of the scandium industry?

Scandium is extremely important for the Green Energy Transition. For example, scandium is used to create a superalloy which decreases an EV’s weight thus increasing its range. Scandium can also make EVs safer in EV vs lighter weight gas powered vehicle collisions (US Transportation Official Warns on Weight of Electric Vehicles– 15 January 2023). Scandium can be used to make everything that moves lighter and more efficient thus decreasing carbon emissions (trains, passenger vehicles, commercial trucks, ships, planes, space crafts, etc.).

What Happens when a Junior Catches the Market’s Attention

Due to all the pending catalysts Doubleview Gold currently has, I believe it has the potential to catch the market’s attention.

Here is an article about what happens when a junior mining stock catches the market’s attention:

DOUBLEVIEW GOLD’S POTENTIAL AFTER IT ATTRACTS THE MARKET’S ATTENTION

Conclusion

Doubleview Gold’s CEO/President recently said the deposit could potentially be one of the most valuable deposits in Canada. In my opinion, he’s being extremely safe with his forward-looking statement as I believe the deposit could potentially be one of the most valuable deposits in North America!

Over the last few years, I have been publicly saying on social media and in my reports on Doublevew Gold that I believe it will be one of the rare companies that gets bought at very high prices.

Over the years and more so now, my biggest fear is Doubleview Gold gets bought out too early making the title of my interview on Doubleview Gold in 2020 “an opportunity of a lifetime” less life changing.

Due to the the Green Energy Transition underway, the potential size of the deposit in the most desirable tier 1 jurisdiction for critical metals, the potential amount (lbs/oz) of critical metals it contains, it potentially having the lowest cost scandium in the world and it potentially being one of the most significant/most valuable critical metals deposit in North America, I believe Doubleview Gold’s days are numbered if it delivers on what it believes it can! The great thing is all the pending catalysts have the potential to prove all of this so within a few months we’ll know!

With a Maiden Resource Estimate expected at the end of 2023/early 2024 and due to all the likely outcomes of all the pending catalysts, I believe this is potentially the final sprint to the finish line in a very long marathon. Interested major mining companies are most likely eagerly awaiting the Maiden Resource Estimate so they can properly price the deposit prior to making an offer.

As average grades increase or average acquisition costs change based on M&A activity, I will update this page accordingly and will republish it. I do expect Doubleview Gold’s average grades to increase once it has successfully found the deposit’s heat engine/feeder zone. Assay(s) from the newly discovered area named “Feeder Zone” is/are pending.

I started T$R in 2020 following chronic illnesses which have prevented my return to work. Never did I think what gave me purpose in life and what helped my inner battles against suicidal thoughts would become a significant independent contributor to Doubleview Gold’s success thus helping minimize my biggest fear with it. I now believe when someone is thrown many challenging life curveballs in the same period it can sometimes be that the universe reassigned someone on a hand picked mission.

T$R is proud to be the only site (sponsored & non-sponsored) that has provided coverage of Doubleview Gold over the years and revealed its potential in a research report when the stock price was only $0.11 in 2020. I believe my original investment thesis will be proven correct in 2024 and if so, it will be life changing for those that had the right conviction and played it correctly.

T$R will continue its mission of turning undiscovered hidden stock gems into life changing investment opportunities!

Reference Material

The following a list of reference material used which wasn’t already mention with a link in the article:

Mineral Deposit Value – How to Calculate the Potential Value of a Mining Project

The Canadian Critical Minerals Strategy

Exclusive: Canada aims to speed up new projects with critical minerals strategy

Canada and U.S. Finalize Joint Action Plan on Critical Minerals Collaboration